knoxville tn sales tax rate 2019

Average example down payment is 95. Current Sales Tax Rate.

Tennessee Sales Tax Rates By City County 2022

The assessment ratio is 40 of the value times the jurisdictions tax rate.

. 1726 Moses Ave Knoxville TN 37921 Jan 18 2022 This prime location offers all the necessities you may need for college town living in a quaint residential neighborhood. City of Knoxville Revenue Office 865-215-2084 citytaxofficeknoxvilletngov City Property Tax Search Pay Online propertytaxknoxvilletngov COUNTY County Tax Questions. Percentage of residents living in poverty in 2019.

The process was extremely easy - one phone call with the recruiter and a video interview knowledge test with 20 multiple choice tax questions. Monthly payment is 2778 for every 1000 you finance. This home was built in and last sold on 7292004 for 7526.

View more property details sales history and Zestimate data on Zillow. 14 Who is Liable for Use. Title registration tax and other fees and personal circumstances such as employment status and personal credit history were not considered in the calculations.

Knoxville is the principal city of the Knoxville Metropolitan Statistical Area which had an. For actual payment rates and term contact 21st Mortgage at 1-800-955-0021 and speak to one of our loan originators. Federal government websites often end in gov or mil.

As of the 2020 United States census Knoxvilles population was 190740 making it the largest city in the East Tennessee Grand Division and the states third largest city after Nashville and Memphis. Johnson City TN 37601 Knoxville TN 37914 423 854-5321 865 594-6100. TN has the 47th highest per capita property tax at 799.

Payment estimate is for a loan to purchase a primary residence. Must take new retail delivery by 02282022. Add these three tax rates together to find the.

March 2019 cost of living index in Knoxville. Tennessee has no income tax which was phased out after 2020. Tennessee does however have a statewide 7 sales tax.

Search our RV inventory for Class A Motorhomes Class C Motorhomes Travel Trailers Fifth Wheels Toy Haulers and Tent Campers for Sale in Nashville TN Chattanooga TN Bowling Green KY Knoxville TN. Please contact us 866-463-9242 for availability as our inventory changes rapidly. Before sharing sensitive information make sure youre on a federal government site.

All calculated payments are an estimate only and do not constitute a commitment that financing or a specific interest rate or. Search Knoxville TN RVs. Rates for non- primary residence such as a secondary residence or rental property may be higher.

Residents of the city are subject to both city and county property taxes. I interviewed for the seasonal tax expert position for CPAs and practicing attorneys. Search our RV inventory for Class A Motorhomes Class C Motorhomes Travel Trailers Fifth Wheels Toy Haulers and Tent Campers for Sale in Nashville TN Chattanooga TN Bowling Green KY Knoxville TN.

My impression was that they did not really care about your actual tax expertise but. 218 185 for White Non-Hispanic residents 340 for Black residents 289 for Hispanic or Latino residents 173 for American Indian residents 305 for Native Hawaiian. Sales tax is 7 with a slightly lower rate on food.

The gov means its official. Multiply the next 1600 by 275 single article rate. Browse photos and price history of this 4 bed 3 bath 3177 Sq.

Localities can also add a sales tax up to 275 making the combined total tax the highest in the nation. 1728 Midway Rd Strawberry Plains TN 37871-1518 is currently not for sale. Please contact us 866-463-9242 for availability as our inventory changes rapidly.

Manufacturer pictures specifications and features may be used in place of actual units on our lot. Recently sold home at 352 Holt Dr Loudon TN 37774 that sold on January 4 2022 for Last Sold for 520000. Any price listed excludes sales tax registration tags and delivery fees.

Click here for a larger sales tax map or here for a sales tax table. Not available with leases and some other offers. SALES AND USE TAX 3 Table of Contents Sales or Use Tax 9 Sales or Use Tax 9 Sales Price 9 Local Option Sales or Use Tax 10 Sales Tax Application to the Lease or Rental of Tangible Personal 12 Property Who Must Register for Sales or Use Tax.

Average is 100 Knoxville TN residents houses and apartments details. 862 less than average US. The absence of state income tax will make your take-home pay higher and provide more income for the basic cost of living purchases.

The average combined rate is about 95 the nations highest average sales tax. Knoxville is a city in and the county seat of Knox County in the US. Any price listed excludes sales tax registration tags and delivery fees.

2 00 APR for 48 months for very. Combined with the state sales tax the highest sales tax rate in Tennessee is 975 in the cities. We sell new.

13 Who is Liable for Sales Tax. 925 7 state 225 local City Property Tax Rate. Intangible property tax is assessed on the shares of stockholders of any loan investment insurance or for-profit cemetery companies.

I do not think I even had to submit my resume. View more property details sales history and Zestimate data on Zillow. As of July 2013 the property tax rate for Knox County residents is 212 per 100 assessed value and the tax rate within the City of Knoxville is 24638 per 100 assessed value.

Price if shown and unless otherwise noted represents the Manufacturers. Text The Phone Number of Your Preferred Store with Your Mobile Device. 1 00 APR for 36 months for very well-qualified buyers when financed wGM Financial.

Actual term rate APR sales price and loan amount may vary. Multiply the first 1600 by local sales tax rate. 1724 McTeer St Knoxville TN 37921-5624 is currently not for sale.

Single Article Tax - 275 of the amount of the purchase price between 160001 and 3200 maximum of 44 State Tax - 7 of the entire purchase price Note. It has a. Since 2016 Tennessee has had no inheritance tax.

Manufacturer pictures specifications and features may be used in place of actual units on our lot. This home was built in 1962 and last sold on for. 212 per 100 assessed value.

If a vehicle is purchased in another state the owner must pay the difference in the tax rate and the current rate in the State of Tennessee in additional to the local tax. 24638 per 100 assessed value County Property Tax Rate. Marginal Income Tax Rates.

Rate TERM Months 00. Shop new motorsports vehicles and equipment in stock at Alcoa Good Times in Louisville TN near Knoxville. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275There are a total of 307 local tax jurisdictions across the state collecting an average local tax of 2614.

All calculated payments are an estimate only and do not constitute a commitment that financing or a specific interest rate or. Single-family home is a bed bath property. Single-family home is a 2 bed 20 bath property.

As of January 29 2022 the TN Dept of Health reports the average positivity rate over the past 7 days is 449 basically no change from the 445 reported on. Bringing Families Together Since 1968.

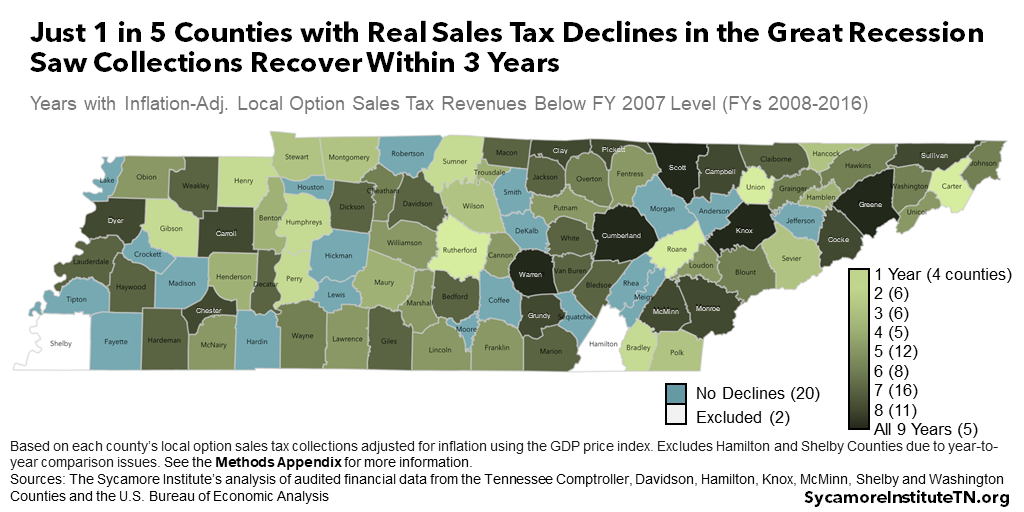

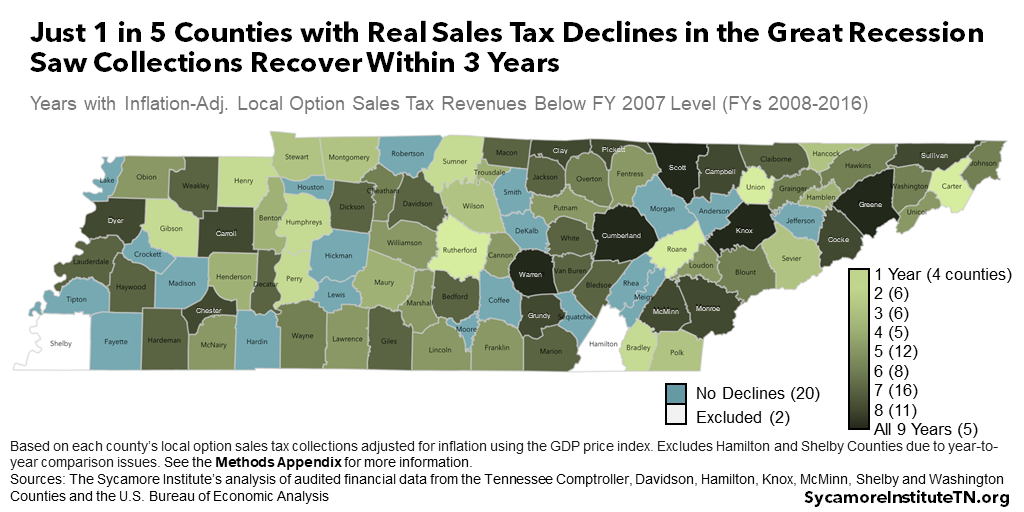

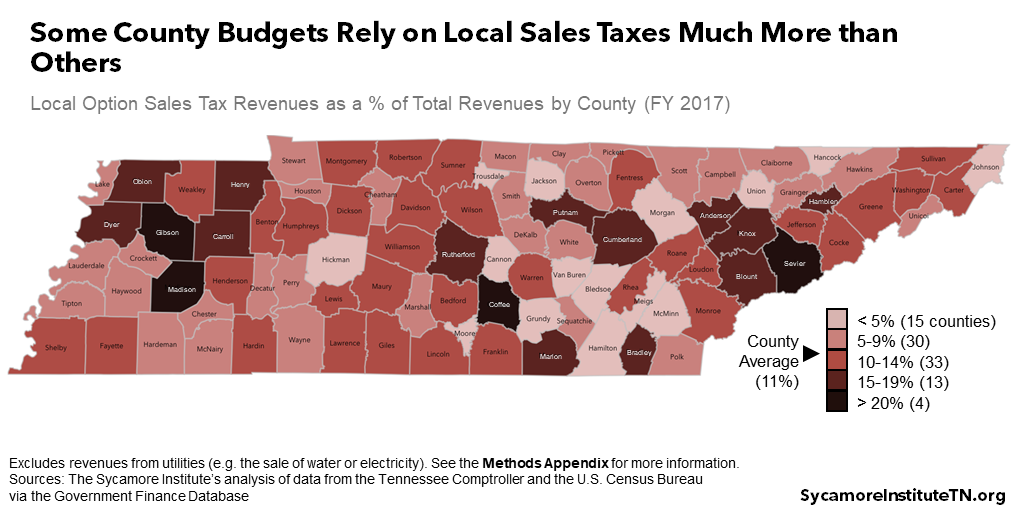

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Historical Tennessee Tax Policy Information Ballotpedia

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

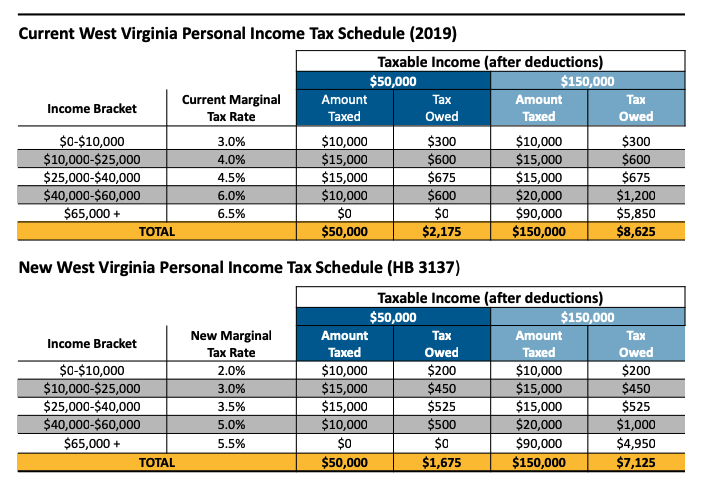

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 West Virginia Center On Budget Policy

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue